In 2023, the primary output for victims of identity theft was spending time resolving the issues, as reported by 43% of those surveyed. Another 33% demonstrated that people had to hold their credit cards due to identity forgery. In total, 94% of respondents had encountered at least one of these consequences in their lifetime.

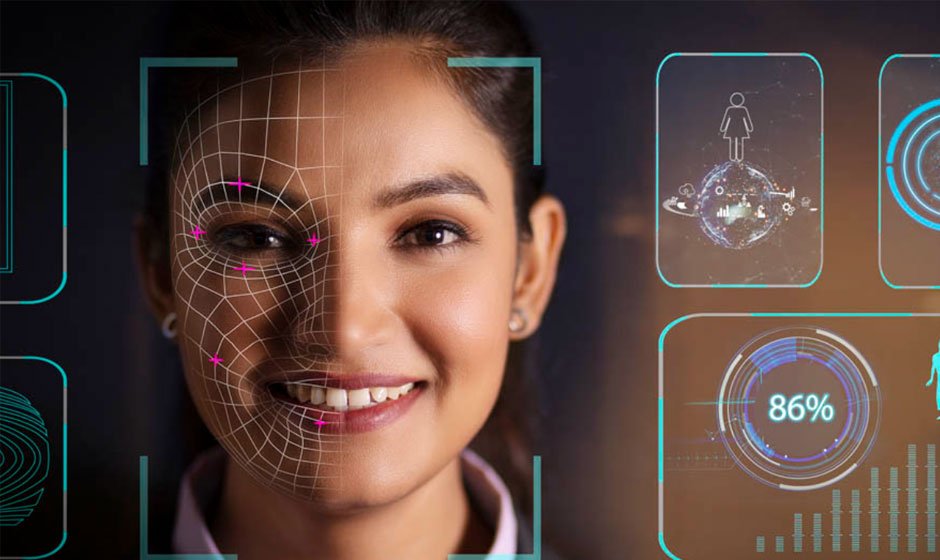

Identity theft has been a prominent issue for decades and requires regulatory compliance to combat fraud. Thus, to fight against identity theft, AI face recognition has come to the ground. It is a powerful tool that is synchronized with advanced technology and convolutional neural networks to prevent identity forgery and has saved billions of dollars.

This article will explore how AI face recognition has changed the dynamics of banking systems and how it has been providing robust security and prevention against financial losses.

Key Features of the Blog

- Comprehending facial recognition scanner

- How digital face recognition works

- Benefits of biometric face recognition

- Face recognition for optimal security in banks

- Face Recognition Services For Robust Compliance against Identity Forgery

What Is a Facial Recognition Scanner?

It is an artificial intelligence-based technological advancement that has the capability to scan the human face. It not only scans the face but also identifies it by comparing it with the existing dataset and then verifies it by correspondence. The facial recognition scanner works wonders in ascertaining the identities of the customers. In banks, AI face recognition has transformed the dilemma of the financial system as it protects the organization’s interest and prevents identity theft with its best capabilities. These devices are broadly used in various organizations in compliance with their requirements and prerequisites. They can be wall-hanged or can be in a mobile app that works through a camera lens. However, there usually are two types of facial recognition scanners that are distinguished on the basis of their analysis, that are:

Biometric face recognition: This scanner makes a map of an individual’s facial features and verifies their identity.

AI face recognition: This scanner uses artificial intelligence, smart algorithms, and structured codes to verify the face using conventional neural networks.

How Does Digital Face Recognition Work?

The digital face recognition system is a sophisticated way to verify or authenticate an individual’s identity using AI-based algorithms that process a digital image or video frame. Here is how digital face recognition verifies the identities:

Data Collection: Customer data is collected from an image or video and considered the source of information and input. That data can be collected from the Internet and incorporated into the system.

Data Examinations: These images and videos are then deeply analyzed to find a similar result if available in the database. It uses the databases of the different regulatory organizations to legitimize the genuineness of the client’s identity.

Data Verification: The analyzed images and videos then undergo the process of verification to find a further match in the database and extract the customer’s existing information from different sources.

Optimal Outputs: The system then provides quick and accurate results by complying with the procedure. It authenticates the customers’ identities and confines if they are previously involved in any financial crime.

Advantages of Biometric Face Recognition

With the authentication of identities, biometric face recognition benefits different sectors with its robust security and compliance against identity theft and money laundering. It upholds extensive data sources and accuracy that provides optimal results every time. The following are a few benefits that financial institutions obtain from opting for AI face recognition:

- Enhanced Security and Safety

- Cost-Efficient

- Fraud Prevention

- Convenience and Efficacy

- Improved User Experience

- Accuracy

- Low Error Rate

- Reliability

Face Recognition Services For Robust Compliance against Identity Forgery

Face recognition solutions determine the distinguishing features of a person’s face depicted in a photo and compare them to the existing database. AI face recognition is becoming popular among industries that continuously face the threat of identity theft and financial fraud. However, digital images and videos are becoming clear evidence and sources of the new data to be extracted and used. Facial recognition services uphold the power to dissuade such activities.

Final Statement

Integrating AI face recognition technology into banking systems has considerable success in the ongoing battle against identity theft and financial fraud. This leverages advanced algorithms and convolutional neural networks with AI. Thus, the innovative solution accurately authenticates customers’ identities and is a formidable barrier to fraudulent activities.

AI face recognition is a critical instrument in protecting the integrity of financial organizations and maintaining their customers’ trust. Its remarkable ability to improve security, smooth compliance processes, and provide an effortless user experience. As cybersecurity continues to evolve, it embraces transformative technologies imperative for ensuring robust protection. It is compliant with occurring perils and maintains the stability of the transnational economic ecosystem.